How To Become A Credit Repair Consultant

Have you ever considered becoming a credit repair skillful? There is a huge market for credit repair specialists and people are desperate for help with repairing their credit. There are several different methods for learning credit repair. It is recommended that you cull a method that complements your learning style before becoming a certified credit repair consultant.

Table of Contents

Becoming a Credit Repair Expert Is Your Next Career

A skilful credit score is one of the most important financial tools an private or business tin possess. Having good credit opens many fiscal doors, such as being able to become good interest rates, secure loans, and make the major purchases yous demand in your life.

Indeed, an improved credit score tin can save you considerable amounts of money in involvement over fourth dimension and go yous loans yous otherwise wouldn't qualify for.

This means at that place is a strong demand for credit repair services that tin can help people get their credit into better shape. It creates a good business opportunity for professionals who have the skill, drive, and cognition to become credit repair specialists and successfully assist people in improving their scores.

Anyone who has a subpar credit rating should seriously consider working with a credit repair consultant to improve their score and maintain it in the years ahead. These services normally work to place incorrect items on your credit history and petition the major credit reporting agencies on your behalf to get them removed.

Bad credit repair companies give credit repair a bad name and incompetent credit repair companies that practice not deed with integrity when working with clients will exist reprimanded. Ignorance of the law is not an excuse.

Exist sure to follow state and federal laws and you should not have to worry about the Consumer Financial Protection Agency penalizing or shutting down your company.

Read and understand the Credit Repair Organizations Human action (CROA). This Act prohibits untrue or misleading representations and requires sure disclosures in the offering or sale of "credit repair" services.

For example, the Human activity bars companies that offering credit repair services from demanding accelerate payment, requires that credit repair contracts be in writing, and gives consumers certain contract cancellation rights.

Importance of Beingness a Credit Repair Agent

The summit methods to acquire credit repair volition be covered in this commodity, only kickoff, allow's discuss why it is important for yous to learn this craft well prior to offer your expertise as a credit repair agent.

The Consumer Financial Protection Bureau (CFPB) is designed to protect consumers. The CFPB has sued several credit repair companies for multiple violations. These credit repair companies took reward of credit repair clients and the CFPB acted swiftly to address complaints confronting credit repair services.

Whatsoever credible preparation should cover the laws that govern restoration. You demand to know what you can and cannot do to stay within the parameters of the constabulary to protect yourself and your clients.

You can not afford to learn credit repair the wrong way. Therefore, it is extremely important to take the time to learn your arts and crafts in order to provide quality service and to protect your business organization and credibility.

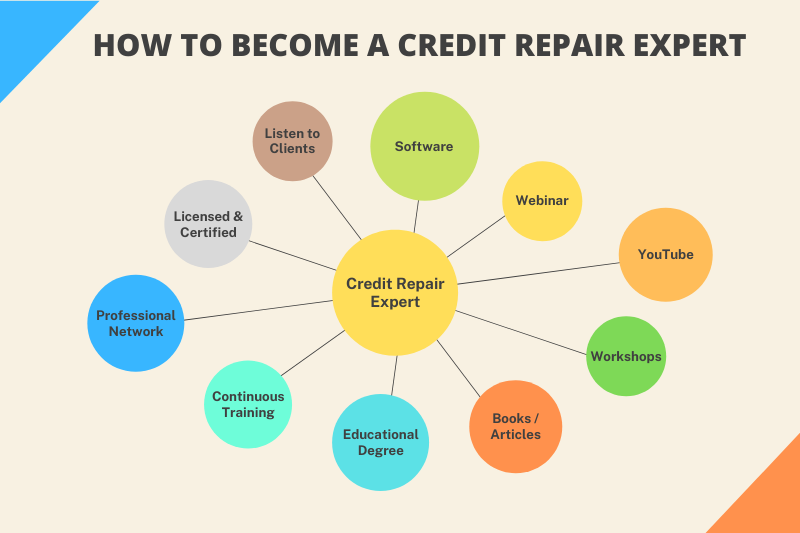

How to Become a Credit Repair Expert

Learn the basics of credit repair before you have on your first client. Exercise the enquiry! You cannot play around with other people's credit report. This is non a hobby, this is a serious business.

Educate yourself. Upkeep for the costs that are needed to obtain the proper training. Explore paid as well every bit free credit repair grooming alternatives.

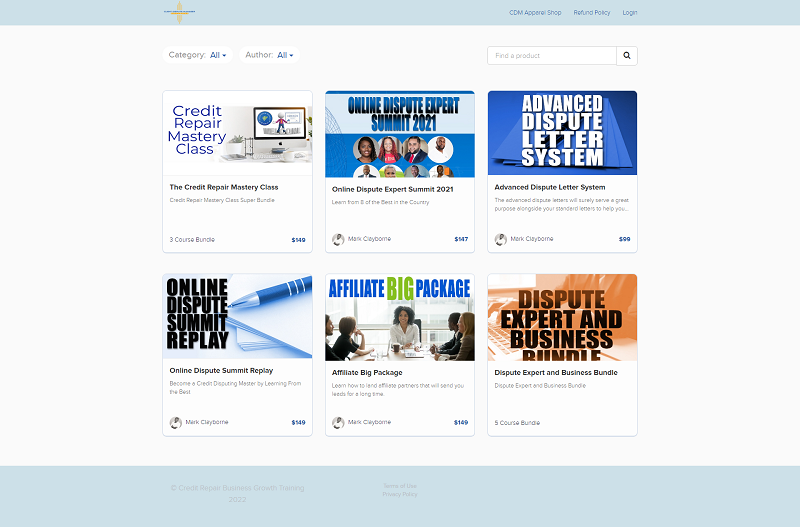

Software

The outset method of learning credit repair is investing in credit repair software. The dispute process is the key to repairing a credit report, so you need to know how to do information technology effectively. Therefore, information technology is crucial to invest in a reliable Credit Repair Dispute Software that provides Credit Repair Specialists with the needed support.

The all-time credit repair software educates Credit Repair Specialists on the dispute procedure equally well as how to apply the software. While learning the software, you will proceeds valuable information and knowledge regarding the credit repair procedure.

There are several recommended credit repair software providers. One of the almost popular is the Client Dispute Manager software. This software is highly recommended considering credit repair training is offered within information technology.

Client Dispute Director software includes very helpful information, and the in-software videos walk y'all through the credit repair process step by step. The software not only manages your customers, just it also offers training on how to dispute, what letters to send, and when to ship them.

Interestingly, it assists with managing your business concern and has extensive training and a pb generation training option, which is crucial to growing your business concern.

Webinar

In addition to selecting the right software, information technology is highly recommended that you ensure that additional preparation is bachelor in a format that complements your learning style.

For example, if you are a visual learner, y'all may prefer to meet the data and grooming cloth. Therefore, highly visual training, such as webinars, may be preferred.

YouTube

Another option for a visual learner is credit repair teaching via YouTube videos. There are informative YouTube videos created by credit repair experts. They provide valuable data on credit repair, the dispute process, how to get started, and how to abound your credit repair business.

YouTube videos are too a corking option for auditory learners and are often free! Auditory learners prefer to hear data, so YouTube videos are a cracking option for auditory learners equally well.

In addition, podcasts or audiobooks may exist a great method to learn about credit repair methods and the manufacture for auditory learners.

Books/Articles/Blogs

Too, if you lot retain information through reading and/or writing, a credit repair course that volition allow you to take notes during the course may be the preferred learning method. Reading articles, blogs, e-zine articles, and books is also suggested. At that place are highly informative books written by credit repair experts that would provide detailed training.

The number one credit repair book in the land is Hidden Credit Repair Secrets by Marking Clayborne. After suffering from a poor credit written report for years, he studied the credit repair industry and was able to repair his credit using his newfound credit repair cognition. He shares his cognition of credit repair in his volume, Subconscious Credit Repair Secrets.

This volume is highly recommended for individuals new to the credit repair manufacture and who want to learn about the credit repair procedure.

Workshops

If reading a volume is only non enough, you may be more of a Kinesthetic learner. As a kinesthetic learner, yous will relish and retain information best through easily-on activities and experiences.

A face-to-face up course or credit repair conference would do good a kinesthetic learner; this would allow interaction through role-playing and easily-on exercises.

Educational Caste

There are no specific degree or didactics requirements to get a credit repair practiced, only having a formal college degree tin can give you an edge in condign a credit repair consultant.

This is especially useful if you are simply starting your career and have the lilliputian practical experience to offering either employers or customers.

A degree in concern or bookkeeping is especially useful. With a primary's degree, more career opportunities volition be open to yous, and you can farther specialize in a particular area to go a credit repair specialist.

A business organisation or entrepreneurial degree gives you a solid foundation in business topics such as marketing, finance, management, and more than, all of which help you showtime and run a business successfully.

An bookkeeping degree teaches you almost key financial topics and practices important for managing business and personal credit. Y'all should also take any college courses offered to you lot that deal in credit or personal finance that are bachelor to you.

Courses in police force, finance, and marketing are also incredibly relevant to this profession.

Continuous Grooming

Continuous training is critically important to every profession, including the credit repair manufacture. Many aspects of the industry alter oftentimes, especially in the area of technology.

Software, for example, has go more than necessary than e'er, and it's important to acquire which programs are heavily used in the industry too as how to use and implement them in your concern.

Seminars, courses, and programs go along you updated on the kinds of services customers expect to receive from a credit repair consultant as well equally irresolute industry standards.

Laws also alter occasionally, and it is important to proceed your knowledge on them upwardly-to-date.

Cultivate A Professional person Network

Networking is also important for maintaining and growing a career as a credit repair specialist. Networking with other professionals not only furthers your ain professional education but puts y'all in affect with people who tin connect you with new clients to grow your business.

You lot tin can too observe quality employees through a professional person network when your business has grown to the point of needing to find additional staff. Professional networks can also provide you with critical continuing education programs and other resources.

Find a mentor credit repair expert if y'all tin can – someone who has experience in the credit repair business and is willing to teach you well-nigh the industry. They tin can be an invaluable resource for helping you avoid mistakes and achieve success as a credit repair expert yourself.

Get Licensed and Certified

While there are usually no specific licenses or certifications required to work as a credit repair consultant in whatever state, having credentials tin can be beneficial to you. Clients are far more probable to use a credit repair specialist accredited by a trustworthy organization.

Non-profit industry organizations typically issue the most prestigious certifications. Also, the ones offered directly from software companies and other vendors can be useful.

If any local or state organizations offering certification or licensure, be sure to obtain those if y'all tin can because information technology will bring your business concern more prestige in your local customs.

Don't forget customer choice awards, besides; these demonstrate to prospective customers that existing customers already highly regard your credit repair business.

Listen to Your Clients

An important but often overlooked way to become a credit repair skillful is to heed to your clients and learn from the experiences you lot take with them. This is invaluable for understanding what y'all are doing correct and the aspects of your business that could employ work.

Other things you can do that could brand your credit business likely to succeed:

- Constantly evaluating your credit repair consultant operations

- Existence willing to make the needed changes

- Striving for improvement at every turn

- Putting your clients' needs beginning

Word of mouth marketing is one of the virtually powerful tools to promote your business. And all it requires is giving customers a skilful experience and encouraging them to recommend you to others.

If you are not sure of your learning style, consider preparation that covers most of the styles of learning and will allow you lot to read, heed, watch, and participate. There is a lot of information to larn and seeing, hearing, reading, and participating will ensure that all learning styles are covered.

The Benefits of Being A Credit Repair Adept

1. The Ability to Help People

One of the greatest joys of working in the credit repair industry is being able to assistance people. Customers come to you hoping you tin can improve something as of import to their quality of life as their credit health, and you are responsible for delivering on that.

This is an enormous responsibility that can feel overwhelming at times merely tin as well be one of the most rewarding careers you can have. When you learn that your help allowed a family unit to buy a home or a pupil finally go out of debt, it creates a potent personal satisfaction that shouldn't be underestimated.

2. The Flexibility to Work as An Employee or Independently

A career as a credit repair specialist is more flexible than other jobs because yous tin seek employment from a traditional employer, go into business for yourself, or even work as a freelance credit repair consultant. This allows for unlike approaches that fit your preferences, career goals, and schedule.

Many people adopt the stability of working for an employer. So some credit repair specialists will wait to work for an established credit repair agency. Others are entrepreneurs at heart and want nada more than to showtime their own business.

Information technology is relatively easy to offset upwards your own credit repair business organisation and begin serving your own clients, but doing so is a major undertaking that should exist taken seriously. For people who are more than interested in freelance work or doing credit repair projects some of the time, you tin can also take on projects and clients when it suits you.

3. You Learn A Lot Most Skillful Credit Management

In the course of your professional work, you volition larn a lot about skilful credit direction practices that not merely help you educate your customers on the topic just will likewise help you in your personal finance.

In teaching your clients nigh the various factors that impact their credit scores and by how much, you can utilise that knowledge to your credit report. You will also learn how of import it is to monitor your credit reports for any imitation data or signs of identity theft.

iv. You Are an Expert

Being an skillful in your field is a prestigious position. Equally a credit repair expert, yous volition exist looked to every bit an authoritative source on the many nuances of this topic. This is a major responsibility, but it can consequence in a lot of pride in your work as a credit repair consultant.

When you take successfully positioned yourself every bit an proficient in your field, yous become aware of the big moving-picture show and how your industry is interconnected with others. A credit repair specialist can specialize in a particular expanse of credit repair and occupy an in-need niche.

5. You Can Utilize Your Noesis

Perhaps you already take extensive knowledge most credit repair topics and would like to utilise that knowledge professionally. You might also already be familiar with business direction or take always dreamed of starting your ain business organisation.

Being a credit repair consultant is an in-demand business opportunity where you can put these skills to piece of work and build a flourishing career as a credit repair specialist out of them.

Roles and Responsibilities of a Credit Repair Expert

There are quite a few roles credit repair experts occupy likewise equally responsibilities you have to your customers.

ane. Being Transparent with Customers

Customers looking for credit repair services are seeking someone trustworthy who can help them achieve a better credit rating. For this reason, y'all must exist transparent and honest in all of your dealings with customers.

Considering credit repair professionals are non strongly regulated, many are subpar, and y'all volition desire to be especially careful to position your business organisation equally credible and effective.

Clients will capeesh transparency and honesty from their credit repair specialists and be more likely to call up highly of you.

ii. Helping People Meet Financial Goals

While credit repair companies cannot magically get consumers out of debt, they provide a number of services that equip clients with the right tools to make amend financial decisions and maintain good credit going forward.

A qualified credit repair specialist will await over the negative items on a credit report and offer a variety of methods to handle each, including their pros and cons.

This helps customers address these negative items in the most effective style possible and ultimately meet their long-term financial goals.

3. Educate Customers on Good Credit Management

Ane of the most of import responsibilities y'all will take in this profession is to educate customers on good credit direction practices to maintain healthy credit going forward.

A credit repair consultant is responsible for educating customers on the options they have to improve their credit to decide for themselves the best way to motility forward.

Each client's financial information and background volition be different, and people learn in different means too. You volition learn to tailor your arroyo to each client and so that they volition get the almost out of your services.

4. Be Knowledgeable About the Major Credit Reporting Agencies

Credit repair customers need to work closely with not only their credit repair specialist only as well with the major credit reporting agencies that oversee consumer credit history. Because of this, you lot demand to have a stiff understanding of how each of these companies works to manage your business most effectively.

The acme 3 credit bureaus are TransUnion, Equifax and Experian. They are are similar, but they also have some notable differences, such equally the fact that a person's credit score tin can vary between the 3 agencies.

It is critically important for a credit repair consultant to understand all current laws and regulations that govern consumer credit. Doing so non simply helps y'all provide improve service to your clients but also prevents your business concern from having legal trouble.

For example, anyone providing credit repair services is required by police to nowadays customers with a written contract outlining what they will practise earlier services are rendered.

A credit repair specialist needs to understand federal and state regulations on credit repair practices. If y'all are e'er in demand of legal advice or take a legal question, be certain to contact an attorney qualified to help credit repair consultants.

5. Know What Laws Apply to The Profession

6. Prioritize Data Security and Privacy

When you work as a credit repair consultant, y'all run a concern that closely handles your customers' sensitive financial information. Hence, it is imperative that you lot prioritize the security of that data.

Undoubtedly, data breaches of sensitive fiscal data tin can exist devastating for your business because you will lose customers' trust. So invest in software and cybersecurity tools upfront to protect the data you work with.

You tin can certainly showcase the data security measures you accept when trying to draw in new customers or affiliates to your business.

Determination

No thing the method you lot cull, the credit repair training that you receive should be easily accessible and detailed. As a Credit Repair Specialist, you volition accept to opportunity to assist thousands of people with your noesis. Invest in your training and you will exist well on your manner to condign a Credit Repair Expert.

Source: https://clientdisputemanagersoftware.com/become-credit-repair-expert/

0 Response to "How To Become A Credit Repair Consultant"

Post a Comment